Debt to Equity Ratio Explained

Restoration Hardware’s cash flow from operating activities has consistently grown over the past three years, suggesting the debt is being put to work and is driving results. Additionally, the growing cash flow indicates that the company will be able to service its debt level. As an example, the furnishings company Ethan Allen (ETD) is a competitor to Restoration Hardware. The 10-K filing for Ethan Allen, in thousands, lists total liabilities as $312,572 and total shareholders’ equity as $407,323, which results in a D/E ratio of 0.76. While not a regular occurrence, it is possible for a company to have a negative D/E ratio, which means the company’s shareholders’ equity balance has turned negative.

- A company with a high ratio might be seen as risky, whereas one with a lower ratio could be viewed as more stable.

- Essentially, the company is leveraging debt financing because its available capital is inadequate.

- As noted above, it’s also important to know which type of liabilities you’re concerned about — longer-term debt vs. short-term debt — so that you plug the right numbers into the formula.

- Last, the debt ratio is a constant indicator of a company’s financial standing at a certain moment in time.

Debt Ratio vs. Long-Term Debt to Asset Ratio

In most cases, this is considered a very risky sign, indicating that the company may be at risk of bankruptcy. Some sources consider the debt ratio to be total liabilities divided by total assets. This reflects a certain ambiguity between the terms debt and liabilities that depends on the circumstance. The debt-to-equity ratio, for example, is closely related to and more common than the debt ratio, instead, using total liabilities as the numerator.

Get in Touch With a Financial Advisor

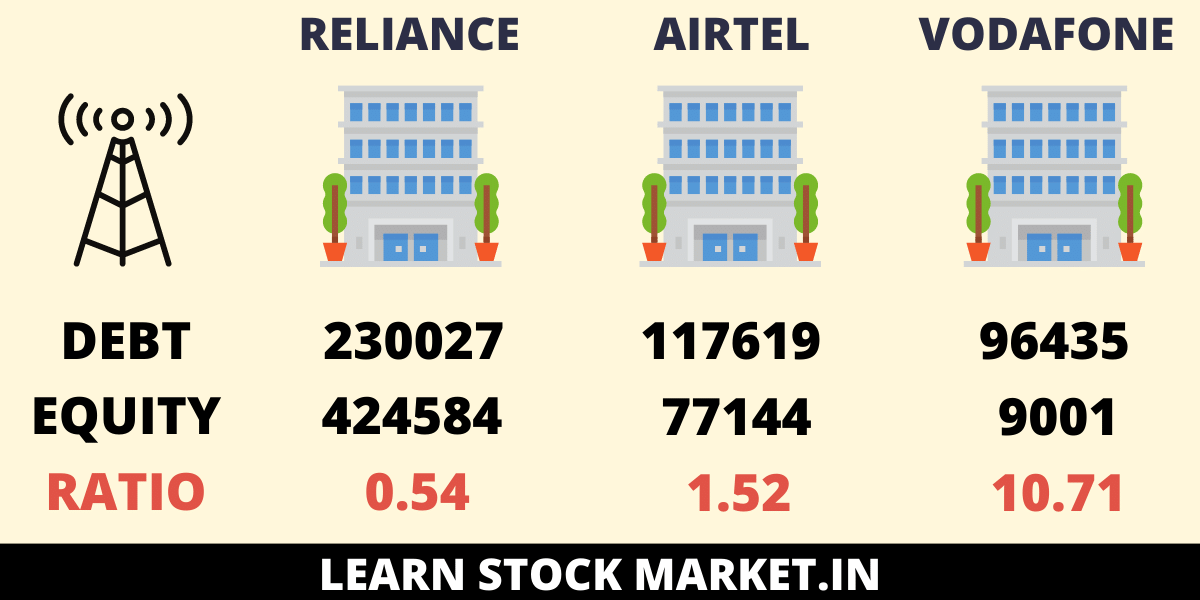

As a result, drawing conclusions purely based on historical debt ratios without taking into account future predictions may mislead analysts. The D/E ratio also gives analysts and investors an idea of how much risk a company is taking on by using debt to finance its operations and growth. It is the opposite of equity financing, which is another way to raise money and involves issuing stock in a public offering. The optimal debt-to-equity ratio will tend to vary widely by industry, but the general consensus is that it should not be above a level of 2.0.

Debt Ratio

You can calculate the D/E ratio of any publicly traded company by using just two numbers, which are located on the business’s 10-K filing. However, it’s important to look at the larger picture to understand what this number means for the business. You can find the balance sheet on a company’s 10-K filing, which is required by the US Securities and Exchange Commission (SEC) for all publicly traded companies.

Debt to Equity Ratio (D/E)

It shines a light on a company’s financial structure, revealing the balance between debt and equity. It’s not just about numbers; it’s about understanding why choose a career in accounting the story behind those numbers. This number can tell you a lot about a company’s financial health and how it’s managing its money.

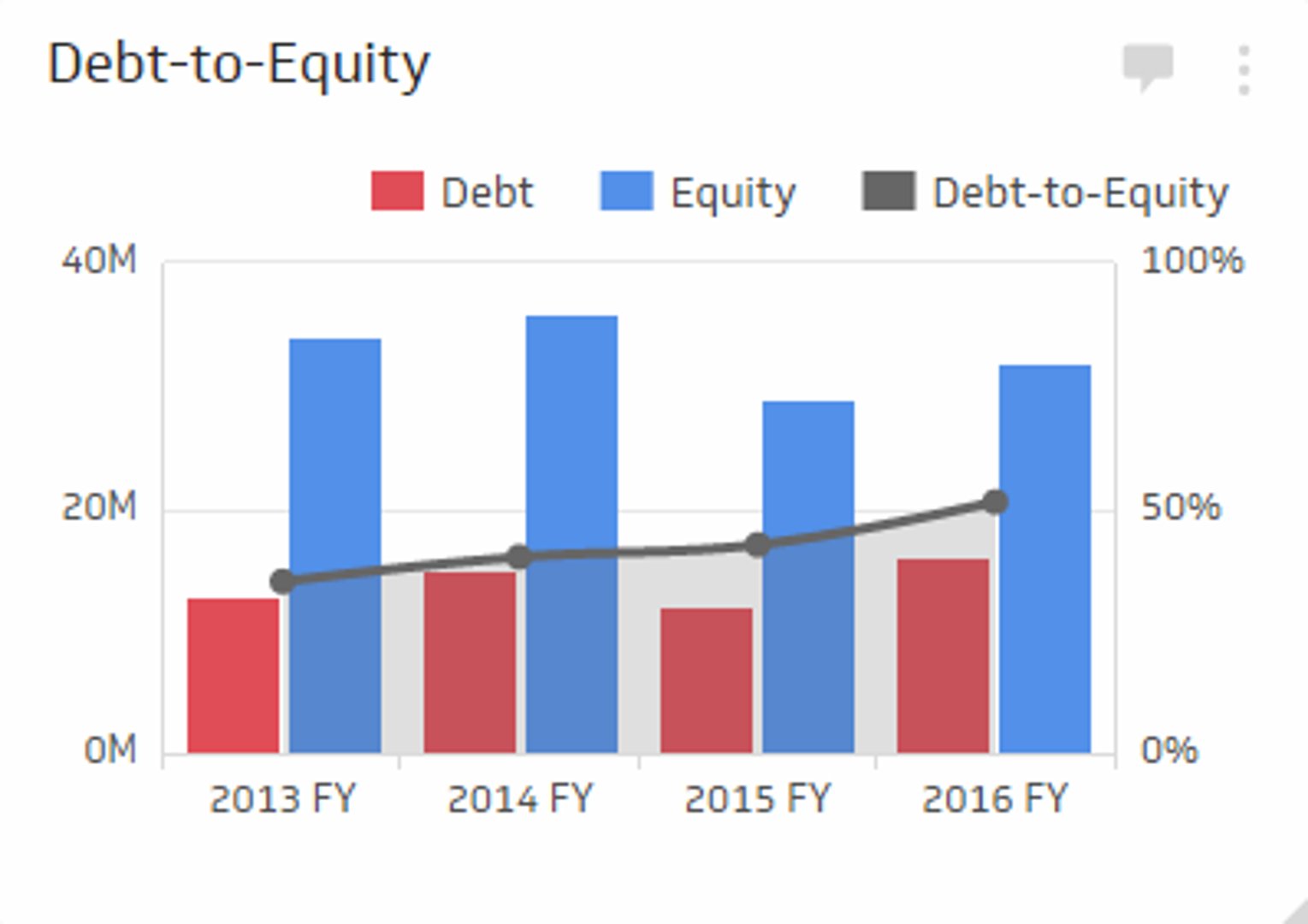

This is helpful in analyzing a single company over a period of time and can be used when comparing similar companies. It is important to note that the D/E ratio is one of the ratios that should not be looked at in isolation but with other ratios and performance indicators to give a holistic view of the company. Overall, the D/E ratio provides insights highly useful to investors, but it’s important to look at the full picture when considering investment opportunities.

Attributing preferred shares to one or the other is partially a subjective decision but will also take into account the specific features of the preferred shares. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. For instance, if Company A has $50,000 in cash and $70,000 in short-term debt, which means that the company is not well placed to settle its debts. Quick assets are those most liquid current assets that can quickly be converted into cash.

While the total debt to total assets ratio includes all debts, the long-term debt to assets ratio only takes into account long-term debts. Therefore, even if such companies have high debt-to-equity ratios, it doesn’t necessarily mean they are risky. For example, companies in the utility industry must borrow large sums of cash to purchase costly assets to maintain business operations.

At the same time, leverage is an important tool that companies use to grow, and many businesses find sustainable uses for debt. A debt ratio greater than 1.0 (100%) tells you that a company has more debt than assets. Meanwhile, a debt ratio of less than 100% indicates that a company has more assets than debt.

If a company’s D/E ratio significantly exceeds those of others in its industry, then its stock could be more risky. We can see below that for Q1 2024, ending Dec. 30, 2023, Apple had total liabilities of $279 billion and total shareholders’ equity of $74 billion. Additional debt issuance, debt repayment, equity issuance, stock buybacks, or changes in retained earnings can all impact the debt and equity components, leading to changes in the ratio.